Arkansas Tax Incentives

What to do when the Affordable Care Act Impacts Case Settlements:

The Benefits of an Accessibility-Focused Case Evaluation

A White Paper by Michael Fiore

One of the likely unintended consequences of the Affordable Care Act is that Special Need Trusts may be impacted due to settlement criteria that can be based on past, present, and future medical needs.

Teleseminars on Disability, Diversity, and the Changing Workforce. One hour of learning that can change the way that you think.

Tech Update: Read an article about the implications of 32-bit and 64-bit processors for Assistive Technology Solutions.

Looking for qualified candidates with disabilities?

![]()

A Job Board for job seekers with disabilities and the businesses looking to hire them.

Arkansas Tax Incentives

Page Contents

- Accessibility Features on Macintosh

- Advantage Arkansas Income Tax Credit

- AgrAbility

- Arkansas Economic Development Commission

- ArkPlus Income Tax Credit

- Arkansas Rehabilitation Services

- Assistive Technology at Work (AT@Work)

- Chamber of Commerce

- Computer Equipment Accessibility Options

- Create Rebate Program

- Department of Workforce Services Training Trust Fund Program

- Existing Workforce Training Program

- Increasing Capabilities Access Network

- Resource Guide for Small Business

- Targeted Business Payroll Income Tax Credit (ACA §15-4-2709)

Accessibility Features on Macintosh

There are several options already available to users of all abilities who own Macintosh computers. There are 4 categories of access offered on a Mac: Literacy and learning; vision; hearing; and physical and motor skills. This fact sheet has information on the features that Macs have to assist with these categories.

MAC Accessibility Fact Sheet PDF

Advantage Arkansas Income Tax Credit

The Consolidated Incentive Act 182 of 2003, as amended, provides an income tax credit to an eligible company for creating new jobs after the company has signed a financial incentive agreement with the Arkansas Economic Development Commission. The annual payroll of the new employees must meet the payroll threshold for the county tier in which the business is located. The income tax credit earned is a percentage of the annual payroll of the new full-time permanent employees and is earned each tax year for a period of five (5) years. Unused credits may be carried forward for nine (9) years beyond the year in which the credit was first earned. The Advantage Arkansas job creation credit cannot offset more than 50% of a business’s income tax liability in any one tax year.

The jobs created as a result of this provision could be occupied by workers with disabilities.

AgrAbility

The vision of AgrAbility is to enable a lifestyle of high quality for farmers, ranchers, and other agricultural workers with disabilities, so that they, their families, and their communities continue to succeed in rural America.

Arkansas Economic Development Commission

The Arkansas Economic Development Commission website has information and links to resources for business owners in Arkansas.

ArkPlus Income Tax Credit

The Consolidated Incentive Act 182 of 2003, as amended, allows the Arkansas Economic Development Commission (AEDC) to provide a ten percent (10%) income tax credit to eligible businesses based on the total investment in a new location or expansion project. The ArkPlus Program requires a minimum investment and a minimum payroll based on the payroll of new full-time permanent employees hired after the date of a financial incentive agreement signed by Arkansas Economic Development Commission.

The business expansion encouraged by this program could mean more employment possibilities for workers with disabilities.

Arkansas Rehabilitation Services

A division of the Department of Career Education, Arkansas Rehabilitation Services has been charged with providing opportunities for Arkansans with disabilities to lead productive, independent lives. To achieve this mission of preparing Arkansans with disabilities to work, Arkansas Rehabilitation Services provides a variety of training and career preparation programs.

Services include career and technical education, transition from school to work or post secondary education, on-the-job training, and ancillary support services that clients may need for successful employment.

Assistive Technology at Work (AT@Work)

AT@Work is an assistive technology assessment service designed to assist Arkansas Rehabilitation Service counselors to ensure their clients receive the maximum benefit from assistive technology in their quest to achieve educational, employment and independent living goals.

Chamber of Commerce

The Arkansas State Chamber of Commerce/Associated Industries of Arkansas is the leading voice for business at the State Capitol and serves as the primary business advocate on all issues affecting Arkansas employers. Its mission is to promote a pro-business, free-enterprise agenda and prevent anti-business legislation, regulations and rules.

Computer Equipment Accessibility Options

This fact sheet has a list of computer equipment options that a person with a disability can use to make the computer more accessible.

Computer Equipment Accessibility Fact Sheet PDF

Create Rebate Program

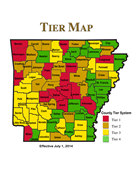

The Create Rebate Program provides annual cash payments based on a company's annual payroll for new, full-time, permanent employees. The benefit depends on the tier in which the company locates. (See Tier Map) In all tiers, a minimum payroll of new, full-time, permanent employees of $2 million annually is required. The minimum payroll threshold must be met within 24 months of the effective date of the financial incentive agreement. No benefits may be claimed until the $2 million annual payroll threshold is met.

This program requires a company to hire full-time, permanent employees. Some of the new hires could be job seekers who have disabilities.

Department of Workforce Services Training Trust Fund Program

The Department of Workforce Services DWS Training Trust Fund Program provides for innovative training support opportunities for qualified Arkansas employers. Specifically, the Department of Workforce Services Training Trust Fund is primarily used to support Arkansas employers in their respective efforts to provide training for prospective, new, and incumbent workers. The benefit of the Department of Workforce Services Training Trust Fund is that it can be used to help fill certain gaps in skills development training that may be otherwise unavailable.

The worker receiving valuable training through this program could be someone with a disability who needs further vocational instruction to sustain employment.

DWS Training Trust Fund Regulations PDF

DWS Training Trust Fund Application PDF

Existing Workforce Training Program

The Existing Workforce Training Program EWTP provides financial assistance to Arkansas's businesses and eligible consortia of businesses for upgrading the skills of the existing workforce to adapt to new or altered technologies and/or acquire new skills needed to remain competitive and economically viable. Training is for full-time, permanent employees who work at least 30 hours a week and are subject to Arkansas's personal income tax. Reimbursements are calculated according to a set of scoring criteria.

An employee receiving training through this program could be someone with a disability who must acquire new, technological skills in order to remain employed.

Tax Incentives Application DOC

Increasing Capabilities Access Network

Assistive Technology (AT) is a broad term that refers to any piece of equipment or device that helps an individual to complete a task and to do so as safely and independently as possible. Increasing Capabilities Access Network (iCAN) is connecting Arkansans with the technology they need to help them learn, work, communicate and live more independently. The services offered are available to all Arkansans, regardless of age, geographic area, disability, income or eligibility for any other service.

Resource Guide for Small Business

This resource guide, published by the U.S. Small Business Administration, can help an entrepreneur in Arkansas plan and prepare a future for his/her business.

Targeted Business Payroll Income Tax Credit (ACA §15-4-2709)

The Consolidated Incentive Act 182 of 2003, as amended by Act 1596 of 2007, provides for income tax credits to “targeted businesses” approved by the Arkansas Economic Development Commission. Companies that are doing business in a targeted business sector and pay wages that are 150% of the state or county average wage, whichever is less, and that meet the requisite payroll and investment thresholds may qualify. The income tax credits earned under this program may be sold upon approval by the Arkansas Economic Development Commission. The buyer of the tax credit shall be subject to the same provisions for carry forward of the tax credits as the business that originally earned the credits. Any unused credits may be carried forward for a maximum of nine (9) years.