Maine Tax Incentives

What to do when the Affordable Care Act Impacts Case Settlements:

The Benefits of an Accessibility-Focused Case Evaluation

A White Paper by Michael Fiore

One of the likely unintended consequences of the Affordable Care Act is that Special Need Trusts may be impacted due to settlement criteria that can be based on past, present, and future medical needs.

Teleseminars on Disability, Diversity, and the Changing Workforce. One hour of learning that can change the way that you think.

Tech Update: Read an article about the implications of 32-bit and 64-bit processors for Assistive Technology Solutions.

Looking for qualified candidates with disabilities?

![]()

A Job Board for job seekers with disabilities and the businesses looking to hire them.

Maine Tax Incentives

- Assistive Technology Demonstrations

- Business Equipment Tax Relief Program

- CareerCenter - Services for Veterans

- Chamber of Commerce

- Commercial Bonds

- Competitive Skills Scholarship Program

- Department of Economic and Community Development

- Devices for Loan

- Direct Loan (Economic Recovery Loan Program)

- Employment Tax Increment Financing

- Equipment Reuse

- Equity Capital

- FAME Program Applications and forms

- Maine Apprenticeship Program

- mPower Loans (Kim Wallace Adaptive Equipment Loan Program)

- Paying for Assistive Technology

- Pine Tree Development Zones

- Regional Economic Development Revolving Loan Program

- State Small Business Credit Initiatives

- Technology Tax Credits

- Vocational Rehabilitation Services

Assistive Technology Demonstrations

An Assistive Technology demonstration allows a consumer to compare the features and benefits of a particular Technology device or category of devices, so he/she can make an informed decision about the product before attaining it.

Business Equipment Tax Relief Program

The Business Equipment Tax Relief program is for equipment and property acquired between April 1, 1995 and March 31, 2007. The reimbursement rate is 100% for the first twelve years and falls incrementally to 50% at year 18 and all subsequent years. This program is no longer in effect for new property and equipment.

The Business Equipment Tax Exemption program eliminates the personal property tax on eligible business equipment that is first subject to assessment on or after April 1, 2007. Business Equipment Tax Exemption has largely replaced Business Equipment Tax Relief and helps businesses avoid paying assessed taxes up front, rather than waiting and filing for a reimbursement, with no time limit to the exemption.

These tax provisions could encourage a business to acquire ADA compliant property allowing for more workers with disabilities to be employed at that business.

Business Equipment Tax Exemption Program Application PDF

Business Equipment Tax Exemption Program Guidelines PDF

CareerCenter - Services for Veterans

The CareerCenter offers specialized employment and training services for Veterans. If you served in the U.S. Armed Forces a CareerCenter Veterans' Representative can help you find a job, get new skills, or access other state or federal resources available to Veterans.

Chamber of Commerce

As the state’s most influential business advocate, the Maine State Chamber of Commerce works to ensure a business climate in which Maine State Chamber members, large and small, can compete successfully in the local, regional, national and world marketplaces.

Commercial Bonds

The State of Maine offers a variety of options that allow businesses to seek funding via tax and tax-exempt bonds. Each program has its own requirements, funding levels, and commitments. This website has a list of these options available to Maine’s business owners.

With the funding from these bonds, a company can employ more workers with disabilities as part of a business expansion or a diversity program.

Competitive Skills Scholarship Program

The Competitive Skills Scholarship helps workers learn new skills and succeed in a changing economy. The program is open to all qualified Maine residents and pays for education and training for high-wage jobs in demand in Maine.

People with disabilities can use this scholarship program to finance higher education or specified vocational training to acquire new skills for success.

Competitive Skills Scholarship Program Brochure PDF

Department of Economic and Community Development

The Department of Economic and Community Development website has links and pertinent information on establishing or growing a business in the state of Maine.

Devices for Loan

Devices for Loan has links to organizations that have assistive technology loan programs.

Employment Tax Increment Financing

The Employment Tax Increment Financing is a state program that helps new and established Maine businesses hire new employees by refunding from 30-80% of the state withholding taxes paid by the business for up to ten years. The reimbursement rate rises with the level of local unemployment, with those in Pine Tree Development Zones receiving the highest rate.

For a business to be reimbursed through this program, it must be a state vendor.

The new employees who are hired as a result of this program could be people with disabilities.

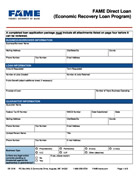

Direct Loan (Economic Recovery Loan Program)

When traditional loans are not the solution for your financing needs, the FAME Direct Loan (also known as the Economic Recovery Loan Program) may be the answer. This program helps your new or existing business with flexible gap financing directly from FAME.

Capital generated by these loans can be used to hire more employees, including those with disabilities.

Economic Recovery Loan Program Application PDF

Equipment Reuse

The Equipment Reuse website has links to organizations where the citizens of Maine can buy, sell and donate “used” assistive technology.

Equity Capital

The State of Maine provides equity capital programs for businesses seeking direct capital investment. This website has a list of these programs available to Maine’s business owners.

Funding awarded through these programs can be used to expand a business. Part of the expansion could be jobs for workers who have disabilities.

FAME Program Applications and forms

This website has links to applications and required documents for all of Fame’s loan programs.

Maine Apprenticeship Program

The Maine Apprenticeship Program assists in setting up structured yet flexible training programs designed to meet the specific needs of Maine employers through on-the-job learning and related classroom instruction. Apprenticeship Programs can be sponsored by employers, employer associations, or labor/management groups that can hire and train in a working situation.

A person with a disability who is starting his/her career can become an apprentice to obtain the skills and experience needed for success.

mPower Loans (Kim Wallace Adaptive Equipment Loan Program)

The Kim Wallace Adaptive Equipment Loan Program provides assistance to individuals and businesses for the purchase, construction or installation of any product or equipment that: allows an individual to become more independent within the community; promotes mobility; or improves independence and quality of life.

A business may use loan funds to facilitate compliance with the Americans with Disabilities Act, allowing for more workers with disabilities to be employed at the business’ workplace. Loans can go as high as $100,000.

For more information on m powerloans program.

Adaptive Equipment Loan Program Application PDF

Paying for Assistive Technology

Assistive Technology is any device, piece of equipment or product that makes it easier for someone with a disability to live more independently, work at a job or learn in school. Assistive Technology can be custom made or commercially available.

This website offers links to funding sources for AT.

Pine Tree Development Zones

The Pine Tree Development Zone program offers eligible businesses the chance to greatly reduce or virtually eliminate state taxes for up to ten years when they create new, quality jobs in certain business sectors or move existing jobs in those sectors to Maine.

Eligible sectors are:

- Biotechnology

- Aquaculture and Marine Technology

- Composite Materials Technology

- Environmental Technology

- Advanced Technologies for Forestry and Agriculture

- Manufacturing and Precision Manufacturing

- Information Technology

- Financial Services

A definition for "new, quality job" is given on the program’s website.

This program can foster job creation, especially for employees with disabilities who have valuable work experience in these industries.

This website has information on how to apply for the Pine Tree Development Zone program.

Regional Economic Development Revolving Loan Program

The Regional Economic Development Revolving Loan Program makes loans through Maine’s regional economic development agencies to help create or retain jobs. FAME makes disbursements to regional economic development agencies and the agencies in turn make loans to eligible borrowers.

Some of the jobs created or retained as a result of this program could be jobs held by employees with disabilities.

State Small Business Credit Initiatives

The State Small Business Credit Initiatives helps Maine small businesses grow and thrive. Funds can be used by businesses at every stage of the business cycle, from start-up costs and acquisition, to expansion. The goal of this program is to stimulate private financing. Unlike other programs, funds are available to both businesses and commercial lenders.

The business expansion generated by this initiative could lead to more employment possibilities for people with disabilities.

Technology Tax Credits

This website has information on Maine’s Technology Tax Credits. These provisions allow companies involved in manufacturing and certain research-driven activities to take advantage of significant credits and tax exemptions for everything from electricity cost to specialized equipment purchases and other expenses involved in R & D.

This website lists and gives a brief description of the tax credits available to manufacturing and research oriented companies located in Maine.

Vocational Rehabilitation Services

The Division of Vocational Rehabilitation is a Department of Labor program that helps people who have disabilities find and keep a job. Vocational Rehabilitation helps people who have physical, mental, or emotional disabilities.

Both of the following websites have information on these types of services in Maine.

Vocational Rehabilitation Services

Vocational Rehabilitation Services Information

This website has the contact information for all of the Rehabilitation Services offices located in Maine.

You can also find a Rehabilitation Services office by searching by town using this website.