Iowa Tax Incentives

What to do when the Affordable Care Act Impacts Case Settlements:

The Benefits of an Accessibility-Focused Case Evaluation

A White Paper by Michael Fiore

One of the likely unintended consequences of the Affordable Care Act is that Special Need Trusts may be impacted due to settlement criteria that can be based on past, present, and future medical needs.

Teleseminars on Disability, Diversity, and the Changing Workforce. One hour of learning that can change the way that you think.

Tech Update: Read an article about the implications of 32-bit and 64-bit processors for Assistive Technology Solutions.

Looking for qualified candidates with disabilities?

![]()

A Job Board for job seekers with disabilities and the businesses looking to hire them.

Iowa Tax Incentives

- Assistive Technology Alternative Finance Program

- Assistive Technology Device Demonstration Services

- Assistive Technology Device Recycle and Reuse Services

- Assistive Technology Device Short Term Loan Program

- Chamber of Commerce Executives

- Employer Resource Guide

- High Quality Jobs Program

- IASourceLink

- Income Tax Benefits for Iowa Employers who Hire Persons with Disabilities

- Iowa Able Foundation

- Iowa Economic Development Authority

- Iowa Innovation Acceleration Fund

- Iowa Vocational Rehabilitation Services Contact Information

- New Jobs Tax Credit

- Registered Apprenticeship

- Targeted Jobs Withholding Tax Credit Pilot Program

- Targeted Small Business Program

- Veteran Employment Services

- Vocational Rehabilitation – Employer Services

Assistive Technology Alternative Finance Program

The Iowa Program for Assistive Technology contracts with the IowAble Foundation to offer three financial services to individuals to pay for assistive technologies or home modifications.

Assistive Technology Device Demonstration Services

The Iowa Program for Assistive Technology supports a program that makes devices available to consumers with disabilities to try out before a decision is made about purchasing it.

Assistive Technology Device Recycle and Reuse Services

The Iowa Program for Assistive Technology supports two programs that put used assistive technology devices into the hands of Iowans who need them.

Assistive Technology Device Short Term Loan Program

The Iowa Program for Assistive Technology supports two programs that provide free short term device loans to consumers with disabilities, so they can try out a device before making a decision about purchasing it.

Chamber of Commerce Executives

Formed in 1916 to enhance the professional development of local chamber executives and professional staff, Iowa Chamber of Commerce Executives continues as the first stop for reaching the business community of Iowa. Innovation with economic development, entrepreneurs and job creation is critical to the growth of local communities. ICCE’s leadership and staff work daily to prepare the local chambers and business leaders to meet the changing demands on our local communities. Improving local communities strengthens Iowa.

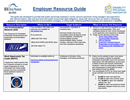

Employer Resource Guide

This guide provides public and private employers information on their legal obligations, along with resources that can assist in identifying, paying for, and implementing effective accommodation strategies, in hiring and/or retaining employees who have disabilities.

High Quality Jobs Program

The High Quality Jobs program provides qualifying businesses tax credits and direct financial assistance to off-set some of the costs incurred to locate, expand or modernize an Iowa facility.

The jobs created as a result of this program can be occupied by qualified workers with disabilities.

IASourceLink

This website has important information and links to resources for Iowa businesses.

Income Tax Benefits for Iowa Employers who Hire Persons with Disabilities

Small businesses that meet certain criteria are allowed an additional deduction on their Iowa income tax returns for hiring persons with disabilities. This web page gives specific information about these benefits.

Iowa Able Foundation

The Iowa Able Foundation offers an alternative financial solution by providing loans with flexible terms to help individuals increase their independence at home, at work, and in the community through the use of adaptive equipment and home modifications. This statewide, nonprofit program will loan funds for any item, piece of equipment or product that is used to improve an individual’s quality of life.

Iowa Economic Development Authority

The mission of Iowa Economic Development Authority is to strengthen economic and community vitality by building partnerships and leveraging resources to make Iowa the choice for people and business. Through our two main divisions – business development and community development – IEDA administers several state and federal programs to meet its goals of assisting individuals, communities and businesses.

Iowa Innovation Acceleration Fund

The Iowa Innovation Acceleration Fund promotes the formation and growth of businesses that engage in the transfer of technology into competitive, profitable companies that create high paying jobs. The funds are designed to support commercializing research, the launching of new start-ups and accelerating private investment and industrial expansion efforts that result in significant capital investment.

Some of the jobs created with the support of this fund could be occupied by qualified employees with disabilities.

Acceleration Fund Program Guide PDF

Innovation Acceleration Fund Application DOC

Iowa Vocational Rehabilitation Services Contact Information

This web page lists Iowa counties in alphabetical order and gives the contact information for the Vocational Rehabilitation Services office located in each county.

New Jobs Tax Credit

The Iowa New Jobs Tax Credit is an Iowa corporate income tax credit that is available to a company which has entered into a New Jobs Training Agreement (260E) and expands its Iowa employment base by ten percent or more. The amount of this one-time tax credit will depend upon the wages a company pays and the year in which the tax credit is first claimed. The maximum tax credit in 2014 will be $1,608 per new employee. Unused tax credits may be carried forward up to ten years.

As Iowa’s employment base expands as a result of this tax credit, so will the job opportunities for people with disabilities.

New Jobs Tax Credit Worksheet PDF

Registered Apprenticeship

The Registered Apprenticeship system provides opportunity for workers seeking high-skilled, high- paying jobs and for employers seeking to build a qualified workforce. In this regard, the Registered Apprenticeship system effectively meets the needs of both employers and workers. Registered Apprenticeship is highly active in traditional industries such as construction and advanced manufacturing. It is also instrumental in the training and development of high demand industries such as healthcare, energy and information technology.

The person being trained as an apprentice could be someone with a disability who requires vocational training to secure employment.

Registered Apprenticeship Training PDF

Targeted Jobs Withholding Tax Credit Pilot Program

The Targeted Jobs Withholding Tax Credit Pilot Program is a pilot program enacted in 2006 which allows the diversion of withholding funds paid by an employer to be matched by a designated "pilot" city to create economic incentives that can be directed toward the growth and expansion of targeted businesses located within a pilot city.

An approved "pilot" city may enter into a withholding agreement: 1) with a business that is locating to its community from another state and is creating targeted jobs within a pilot city; or 2) an existing Iowa business that is creating ten new targeted jobs or makes a qualifying investment of $500,000 within an urban renewal area.

Some of the jobs created by this program can be held by employees with disabilities who are residents of the”pilot” cities.

Targeted Small Business Program

The Targeted Small Business Program of Iowa is designed to help women, minorities and entrepreneurs with disabilities overcome some of the major hurdles to starting or growing a for-profit small business in Iowa. Since its inception over two decades ago, the Targeted Small Business program has issued hundreds of loans to Iowa small business owners.

Targeted Small Business Program Fact Sheet PDF

Targeted Small Business Program Application PDF

Veteran Employment Services

Veteran Representatives, who are all honorably discharged service members, coordinate all services provided to eligible veterans within the IowaWORKS system. They work with eligible veterans and clients of Veterans Administration Vocational Rehabilitation to:

- Conduct productive job searches;

- Access job listings;

- Develop job interviewing and resume writing skills;

- Help place eligible veterans in federally-funded employment and training programs;

- Monitor job listings from federal agencies and federal contractors to ensure veterans get priority service in referral to these jobs; and

- Provide intensive services to meet the employment needs of eligible veterans.

These services provide veterans with the necessary information needed to find and secure suitable employment.

Vocational Rehabilitation – Employer Services

The Iowa Vocational Rehabilitation Services IVRS helps prepare persons with disabilities for employment. These individuals have a wide range of skills and abilities. In the past 75 years, IVRS has placed over 120,000 Iowans with disabilities in areas such as:

- Administrative and Support Services

- Computer Software and Hardware

- Education

- Healthcare

- Construction

- Hospitality and Tourism

As an employer, you are naturally concerned with selecting the right person for each position in your organization. Our professional staff is committed to matching our candidates with your positions. You can be assured that IVRS has the needs of your business in mind when referring a potential worker to you.

-1.jpg)